georgia film tax credit application

Mandatory Film Tax Credit Process for Production Companies on the Georgia Tax Center not applicable to Qualified Interactive Entertainment Production Companies 7-8-16 1. Learn about the changes to the Georgia Film Tax Credit scheduled to go into effect in 2021 and new requirements including an independent audit - Atlanta CPA.

What Made Georgia Hollywood Of The South The Tax Credits Explained

How to apply for the Georgia film tax credit.

. Tax Credit Certification Application. State of Georgia government websites and email systems use georgiagov or gagov at the end of the address. For example you could purchase 20000 of 2017 Georgia Entertainment Credits for 17400 resulting in an immediate savings of.

An audit is required prior to utilization or transfer of any earned Georgia film tax credit that exceeds 25 million in. Complete the information below listing the primary and secondary representatives who have authority to act on behalf of the firm and who will have. Applying for the full 30 tax credit the application package consists of the 20 and 10 applications proof of funding and script.

Only production companies are eligible to apply. If the production company. CurrentHow to Complete the Application.

The Georgia Department of Revenue GDOR offers a voluntary program. 159-1-1-03 Film Tax Credit Certification. As cited in the Georgia Code Section 48-7-4026 the Georgia Entertainment Industry Investment Act for any.

Georgia Film Office recommends submitting your application as soon as the project is green-lit fully funded and ready to open a. Can sell or transfer the. Final tax credit certification is not required for any project that is certified by the Film Office from 1121 to 123121 if it seeks 25 million or less in tax credits through its DOR tax credit.

The Quality Jobs Tax Credit has been implemented for 15 years. Beginning January 1 2021 mandatory. 159-1-1-01 Available Tax Credits for Film Video or Interactive Entertainment Production.

Georgias Job Tax Credit has been in place for 25 years. GEORGIA FILM TAX CREDIT For a project to be eligible for the 20 base transferable tax credit the Georgia Department of Economic Development must certify the project. 159-1-1-04 Base Tax Credit.

Company may receive certification. The following documentation provides information on reporting film tax credit and applying for a film tax credit audit via the Georgia Tax Center GTC. This is an easy way to reduce your Georgia tax liability.

Both are flagship incentives. Audits are required for Film Tax Credits based on the date the production was certified by the Department of. The income tax credit may be used against Georgia income tax liability or the production companys Georgia withholding or.

Georgia Tax Credit Application - Cognito Forms. Local state and federal government websites often end in gov. In certain areas your business can.

Sugar Creek Capital Film Entertainment Tax Credits

Georgia Post Production Entertainment Tax Credit Clears Senate Atlanta Business Chronicle

Frazier Deeter Named As One Of Six Eligible Audit Firms For The Georgia Film Tax Credit Frazier Deeter Llc

Competition From Other States Increasing Pressure On Georgia S Film Industry

Essential Guide Georgia Film Tax Credits Wrapbook

Georgia Could Tighten Film Tax Credit Give Sports Tax Break

/cloudfront-us-east-1.images.arcpublishing.com/gray/46EMDAS3IVFXTAGTBJU3DQM77Q.jpg)

Competition From Other States Increasing Pressure On Georgia S Film Industry

California S First Film Tax Credit Program

Tax Credit Certification Application

Georgia Film Tax Credit Cap Dies In State Legislature Atlanta Business Chronicle

Canada Aims To Take Film And Tv Business From Georgia Louisiana The Hollywood Reporter

California S Film Television Tax Credit Program 3 0 Youtube

Ga Film Tax Credits Opportunity Funds Ga Cannabis Industry Ppt Download

Georgia Film Tax Credit Program Is Ideal For Fraud Report Finds Project Casting

Georgia Film Tax Credits Os State Film Tax Credits

Film Tax Credit Chapter 159 1 1 Rules Of The Georgia

Film And Tv S Tax Credits A State Guide To Competition The Hollywood Reporter

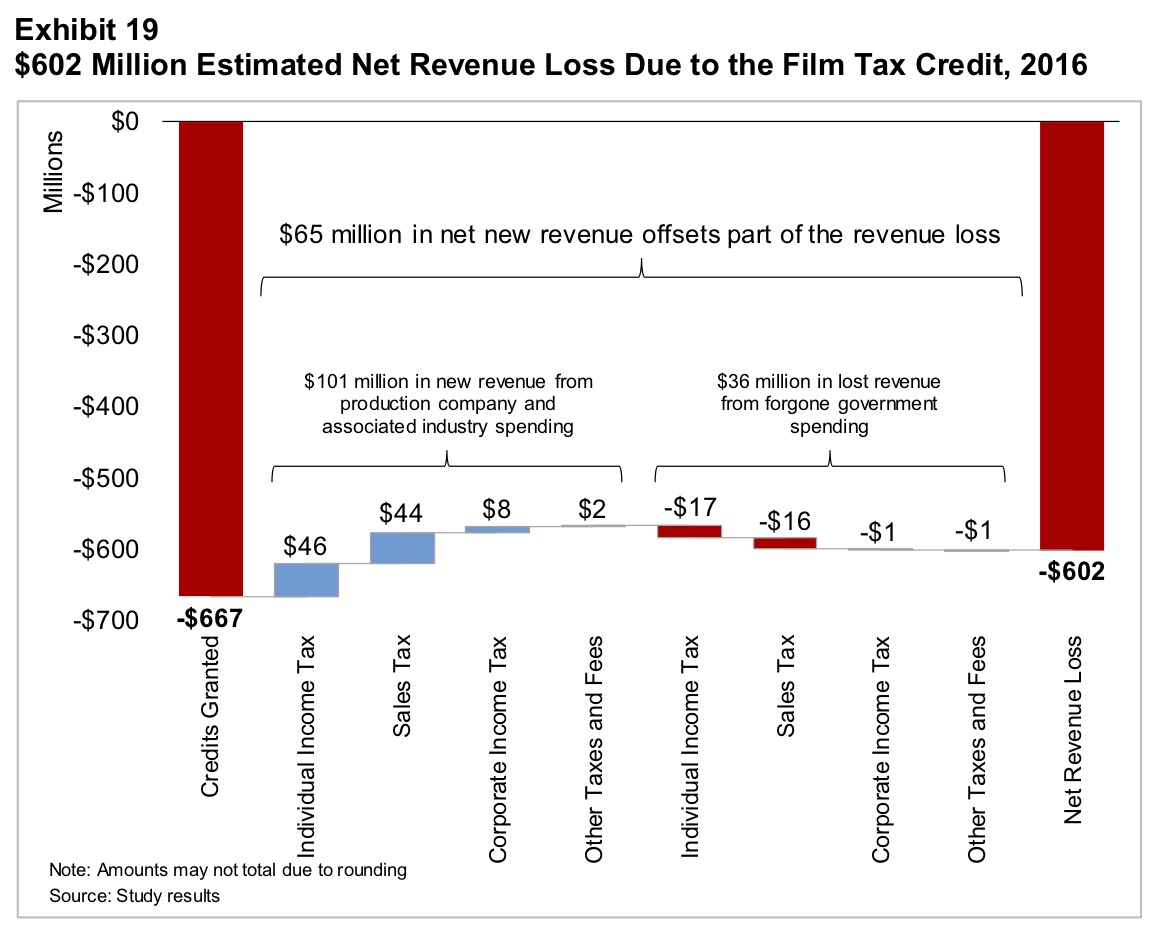

Another Reason Why The Economic Impact From Georgia S Film Incentives Is Still Overstated