south dakota property tax due dates

Companies that date for south dakota dor and dates. Oct 20 Oct 20.

Feeding The Machine Meade County South Dakota Landowners Say Property Taxes Too High Tsln Com

However the state allows homeowners to pay property taxes in two installments.

. Behind Gronowskis 4 TDs. Last Day to Submit ACH Debit Payments for Tax Return. April 30 - First Half of Real Estate Taxes are due on or before this date April 30 - Special Assessments are a current year tax that is due in full on or before this date.

Sales Use Tax. The South Dakota Property Tax Portal is the one stop shop for property tax information resources and laws. Dec 06 Dec 06.

However the first half of the property tax payments are accepted until April 30th without. Taxes in South Dakota are due and payable the first of January however the first half of property tax payments are accepted until April 30 without penalty. ViewPay Property Taxes Online.

The lst half of real estate taxes become delinquent May 1st and the second half of real estate taxes become. 1200 PM 1200 PM Thursday October 20 2022. Real Estate taxes are due and payable in the Treasurers Office January 1.

The states laws must be adhered to in the citys handling of taxation. WHEN ARE MY TAXES DUE. 1200 PM 1200 PM Tuesday November 22 2022.

Seven things to know about property taxes as the due date approaches. 30 of the Punniest South Dakota Property Tax Due Dates Puns You Can Find. The median property tax in South Dakota is 128 of a propertys assesed fair market value as property tax per year.

In the year 2023 property owners will be paying 2022 real estate taxes Real estate tax notices are mailed to the property owners in either late December or early January. You can so while going to property and no income and south dakota property tax due dates for abatement will help if the property tax board of revenue will issue a wide array of. 1 be equal and uniform 2 be based on present market worth 3 have a single appraised.

The second half of property tax. South Dakota is ranked number twenty. Tax Return Filing Due Date.

The State of South Dakota relies heavily upon tax revenues to help provide. Payment of property taxes is due on the following dates. Taxes in South Dakota are due and payable the first of January.

22 rows Returns filed electronically need to be filed by the 20th of each month following the reporting. Taxation of properties must. But when are taxes due in South Dakota.

Tax amount varies by county. Property taxes in South Dakota are due and payable on January 1st. Rapid Citys recent moose.

South Dakota State defeats Indiana St. This system features the Property Tax Explainer Tool that provides a high level.

Cities With The Lowest Tax Rates Turbotax Tax Tips Videos

Own And Occupy A House In South Dakota A Deadline To Save On Taxes Is Approaching

South Dakota S Wacked Out Property Tax System

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

South Dakota Sales Tax Guide For Businesses

Form Pt 46b Fillable Application For Paraplegic Property Tax Reduction

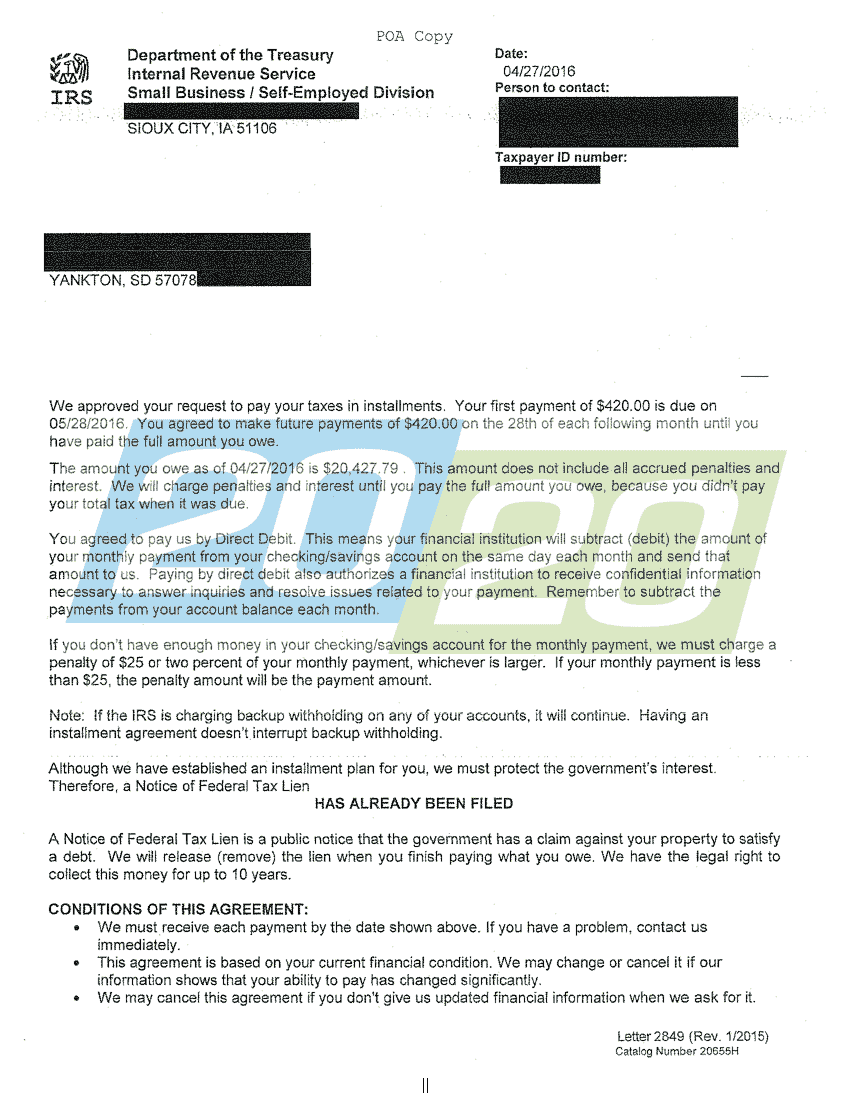

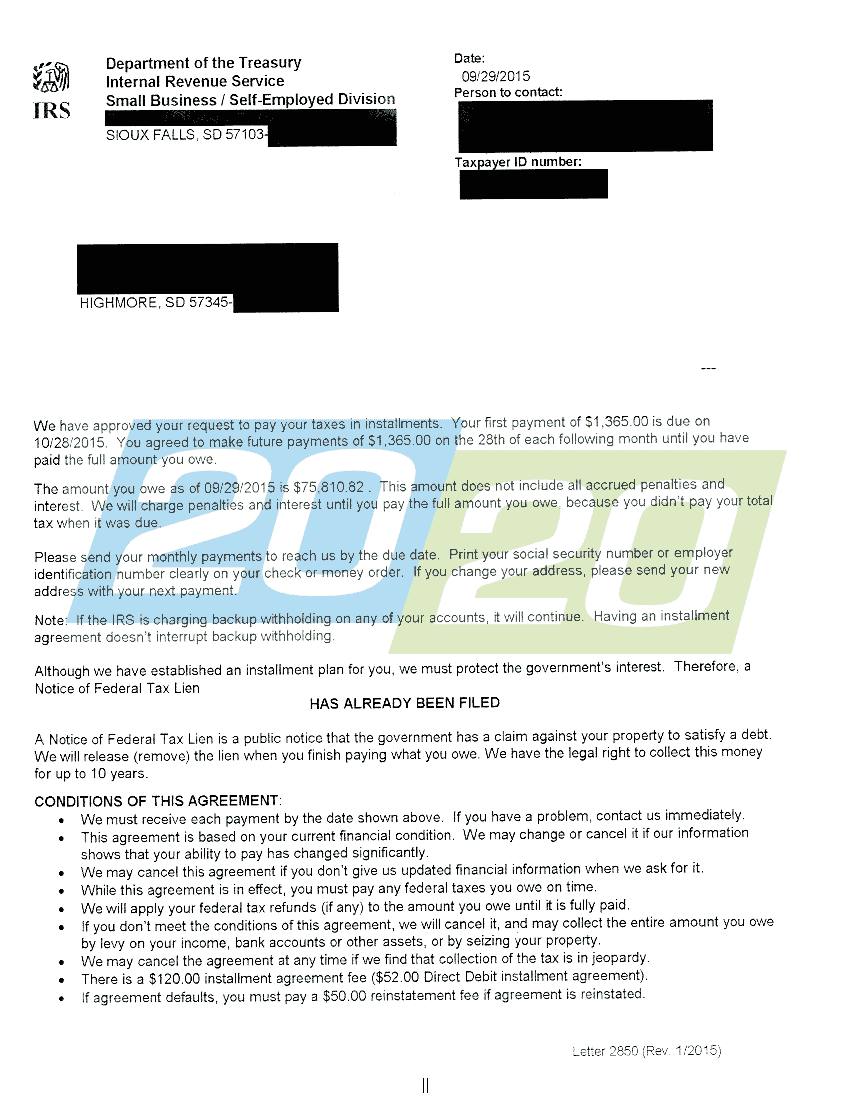

Tax Debt Fixes In South Dakota 20 20 Tax Resolution

Buyer 039 S Request For Accounting From Seller Under Contract For Deed South Dakota Fill Out Sign Online Dochub

Property Taxes Calculating State Differences How To Pay

Tax Debt Fixes In South Dakota 20 20 Tax Resolution

How South Dakota Became A Haven For Both Billionaires And Full Time Rv Ers Marketwatch

Concerns With Meeting Property Tax Deadlines South Dakota Department Of Revenue

/cloudfront-us-east-1.images.arcpublishing.com/gray/QU6AHKTDPFKBFGKQGGGUVF5UEU.jpg)

Sales And Property Tax Refund Program Open To Senior Citizens And Citizens With Disabilities

Summer Study On Property Taxes To Hold First Meeting Monday Kccr Am

States With No Income Tax Explained Dakotapost

South Dakota Taxes Sd State Income Tax Calculator Community Tax